Long-Term vs. Short-Term Real Estate Investments in Kenya

The intricacies of long-term versus short-term real estate investments in Kenya, providing a comprehensive overview of each approach,

Long-Term vs. Short-Term Real Estate Investments in Kenya: Which is Right for You?

Kenya's real estate market is a dynamic and ever-evolving landscape, presenting a diverse range of investment opportunities for both seasoned and novice investors1. As the country continues its trajectory of economic growth and urbanization, the real estate sector offers attractive avenues for wealth creation and financial security. However, navigating this complex market requires careful consideration of various factors, including investment goals, risk tolerance, and the prevailing economic climate. This report delves into the intricacies of long-term versus short-term real estate investments in Kenya, providing a comprehensive overview of each approach, while also examining the current economic situation and its potential impact on investment decisions.

Research Methodology

This report draws on a variety of sources to provide a comprehensive overview of long-term and short-term real estate investments in Kenya. The research process involved analyzing industry reports, market data, academic publications, and news articles related to the Kenyan real estate market. Specific sources consulted include reports from the World Bank, the African Development Bank, and Knight Frank, as well as articles from Kenyan Wall Street and BuyRentKenya. In addition, the research team examined case studies of successful real estate projects in Kenya and other African countries to provide real-world examples and insights.

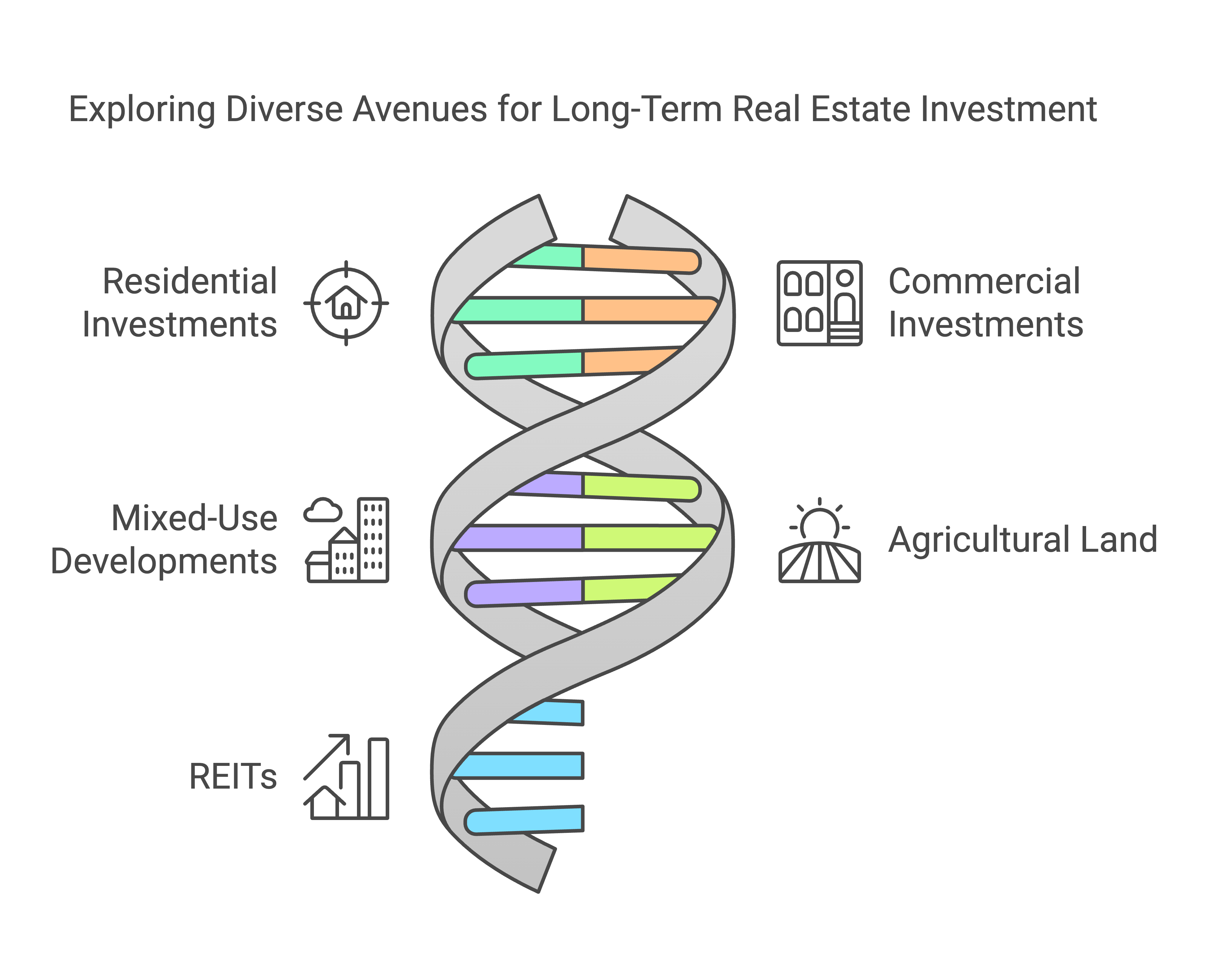

Types of Long-Term Real Estate Investments in Kenya

Long-term real estate investments typically involve holding onto a property for an extended period, ranging from several years to decades, with the expectation of generating passive income and capital appreciation over time. Here are some common types of long-term real estate investments in Kenya:

-

Buying Your Own Home: While often overlooked as an investment, purchasing a primary residence offers long-term benefits such as financial security and stability. Homeownership eliminates rental expenses and allows homeowners to build equity over time2.

-

Residential Rental Properties: Investing in residential properties for rent is a popular strategy for generating passive income. Landlords can earn consistent rental income while benefiting from property appreciation. However, this approach requires active management, including tenant selection, property maintenance, and handling legal and regulatory compliance2.

-

Commercial Real Estate: Investing in commercial properties, such as office buildings, retail spaces, and warehouses, can provide substantial rental income and long-term appreciation. These properties are often leased to businesses on long-term contracts, ensuring a stable income stream. However, commercial real estate investments typically require higher capital outlay and may be subject to market fluctuations3.

-

Two Rivers Mall: Located in Nairobi, Two Rivers Mall is the largest mall in East and Central Africa4. It offers a diverse range of retail, entertainment, and lifestyle options, making it an attractive destination for shoppers and businesses alike. Investing in commercial spaces within Two Rivers Mall can provide long-term rental income and potential for capital appreciation as the mall continues to grow and attract more visitors5.

-

Kigali Innovation City: Situated in Kigali, Rwanda, Kigali Innovation City is a mixed-use development focused on technology and innovation6. It aims to attract tech companies, startups, and educational institutions, creating a vibrant hub for economic growth. Investing in commercial or residential properties within Kigali Innovation City can provide long-term returns as the project develops and attracts more businesses and residents7.

-

Eko Atlantic: Located in Lagos, Nigeria, Eko Atlantic is a large-scale, mixed-use development built on reclaimed land8. It offers a range of investment opportunities, including residential apartments, commercial spaces, and retail outlets. With its modern infrastructure and prime location, Eko Atlantic presents potential for long-term capital appreciation and rental income9.

-

Agricultural Land: Investing in agricultural land offers long-term appreciation potential and the possibility of generating income through farming activities or leasing the land to farmers. However, this type of investment requires careful consideration of factors such as land fertility, water availability, and market access for agricultural produce3.

-

REITs (Real Estate Investment Trusts): REITs provide a unique way to invest in real estate without directly owning physical property. By purchasing shares in a REIT, investors can gain exposure to a diversified portfolio of income-generating real estate assets, such as shopping malls, office buildings, and residential complexes. REITs offer liquidity, as shares can be traded on the stock exchange, and provide a regular income stream through dividends3.

Pros and Cons of Long-Term Real Estate Investments

|

Advantages |

Disadvantages |

|---|---|

|

Appreciation: Real estate generally appreciates over time, allowing investors to build equity and potentially realize significant capital gains upon selling the property10. |

High Initial Costs: Acquiring a property requires a substantial upfront investment, including the down payment, closing costs, and potential renovation expenses10. |

|

Passive Income Potential: Rental properties generate a steady stream of passive income, providing financial stability and supplementing other income sources10. |

Illiquidity: Real estate is not a liquid asset, and selling a property can take time, making it less flexible compared to other investments like stocks10. |

|

Tax Benefits: Investors can benefit from various tax deductions, including mortgage interest, property taxes, and depreciation, which can reduce their overall tax burden10. |

Ongoing Maintenance and Management: Property ownership entails ongoing responsibilities, such as property maintenance, tenant management, and handling legal and regulatory compliance11. |

|

Inflation Hedge: Real estate often acts as a hedge against inflation, as property values tend to rise during inflationary periods10. |

Market Volatility: While real estate generally appreciates over the long term, it can be subject to market fluctuations and economic downturns, which may affect property values and rental income11. |

|

Equity Building: As tenants pay down the mortgage, investors build equity in the property, increasing their ownership stake and potential for future financial gains12. |

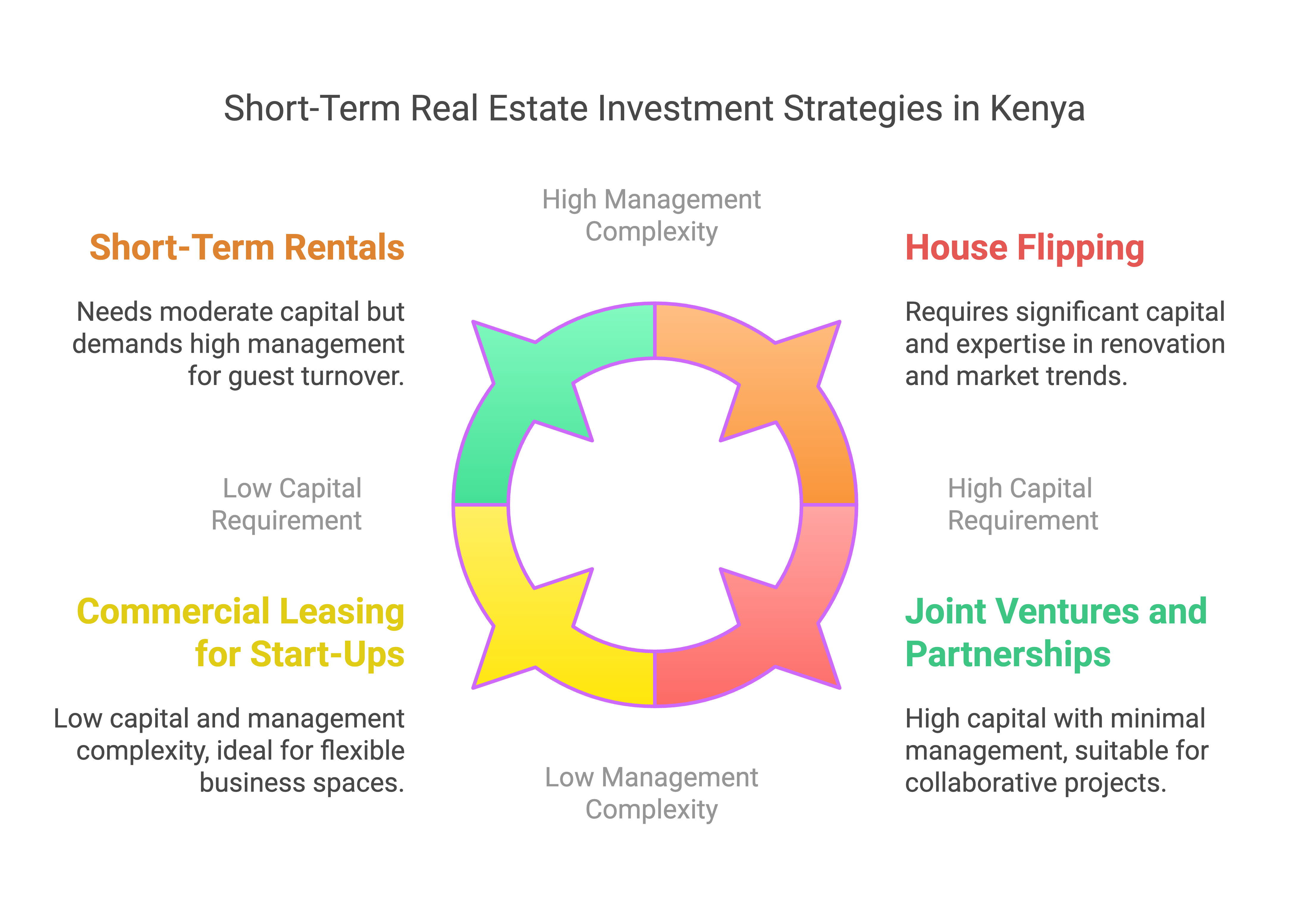

Types of Short-Term Real Estate Investments in Kenya

Short-term real estate investments involve holding a property for a shorter duration, typically less than a year, with the aim of generating quick returns through strategies like flipping or short-term rentals. Here are some common types of short-term real estate investments in Kenya:

-

House Flipping: This strategy involves buying undervalued properties, making necessary renovations or improvements, and quickly reselling them at a higher price. Successful flipping requires market knowledge, renovation expertise, and the ability to manage costs effectively3.

-

Short-Term Rentals: Platforms like Airbnb have fueled the growth of short-term rentals in Kenya. Property owners can rent out their properties to travelers for short stays, generating higher daily or weekly rental income compared to long-term rentals13. This approach is particularly attractive in tourist destinations and urban centers with high demand for temporary accommodation.

-

Eko Atlantic: Eko Atlantic, with its diverse range of residential and commercial properties, also presents opportunities for short-term investments. Investors can purchase properties and leverage platforms like Airbnb to generate short-term rental income, particularly during peak tourist seasons or for business travelers seeking temporary accommodation8.

-

Commercial Leasing for Start-Ups: Short-term commercial leases cater to businesses, particularly start-ups and small enterprises, that require flexible and temporary office or retail spaces. This approach provides property owners with quick returns and allows businesses to adapt to changing needs without long-term commitments3.

-

Joint Ventures and Partnerships: Investors with limited capital can participate in short-term real estate projects through joint ventures or partnerships with developers. This allows them to invest in specific projects and exit upon completion, generating quick returns without the burden of long-term ownership3.

Pros and Cons of Short-Term Real Estate Investments

|

Advantages |

Disadvantages |

|---|---|

|

Quick Returns: Short-term investments can generate faster returns compared to long-term investments, providing liquidity and allowing investors to reinvest their capital in other opportunities14. |

Higher Risk: Short-term investments are generally riskier due to market fluctuations, potential for vacancies, and the need for quick turnaround times15. |

|

Market Flexibility: Short-term investors can adapt quickly to market changes and trends, potentially capitalizing on emerging opportunities or avoiding downturns more effectively14. |

Higher Operating Costs: Short-term rentals often involve higher operating costs, including cleaning fees, marketing expenses, and potential property management fees16. |

|

Forced Appreciation Opportunities: Strategies like flipping allow investors to "force" appreciation by adding value to properties through renovations or improvements, generating higher returns in a shorter timeframe14. |

Inconsistent Income: Short-term rental income can be inconsistent, particularly in seasonal markets, making it challenging to predict cash flow and budget effectively17. |

|

Higher Profit Margins: Well-executed short-term investments can offer higher profit margins compared to long-term investments, especially in markets with strong demand and favorable conditions14. |

Legal and Regulatory Challenges: Short-term rentals may be subject to specific regulations and licensing requirements, which can vary by location and require careful compliance13. |

Current Economic Situation in Kenya

Kenya's economy has shown resilience in the face of recent global challenges, including the COVID-19 pandemic and the war in Ukraine. The country's real GDP expanded at an estimated 5.4% in 2023, driven by a rebound in the agricultural sector and moderate growth in services18. The real estate industry has also demonstrated stability, with the market performing well across various sub-sectors19. According to the Kenya National Bureau of Statistics, real estate contributed 9.3% to the GDP in 20221. However, the country faces several economic challenges, including:

-

High Inflation: Inflation remains elevated, eroding purchasing power and potentially impacting affordability in the real estate market. For example, the high inflation rates in 2024 led to a decline in housing activity in the low-market segment, while the high-market segment (luxury real estate) saw a significant increase in activity20.

-

High Debt Burden: Kenya's public debt has risen significantly in recent years, raising concerns about fiscal sustainability and potential impacts on government spending and investment21.

-

Depreciating Currency: The Kenyan shilling has depreciated against major currencies, potentially affecting the cost of imported construction materials and influencing investment decisions. This depreciation has prompted Kenyan diaspora and local investors to explore opportunities in foreign real estate markets with more stable currencies22.

-

Climate Change: Kenya is vulnerable to climate change impacts, including droughts and floods, which can disrupt economic activity and affect property values in certain regions23.

How the Economic Situation Might Affect Real Estate Investments

The current economic situation in Kenya presents both opportunities and challenges for real estate investors.

-

Affordable Housing Demand: The high inflation and affordability challenges may increase demand for affordable housing, creating opportunities for investors in this segment24.

-

Shifting Commercial Real Estate Trends: The rise of remote work and co-working spaces may impact demand for traditional office spaces, while logistics and mixed-use properties show promise1.

-

Infrastructure Development: Ongoing infrastructure projects can boost property values in surrounding areas, creating investment opportunities25.

-

Government Initiatives: Government policies, such as the Affordable Housing Program, can incentivize real estate investment and support specific market segments26.

Luxury Real Estate Market in Kenya

The luxury real estate market in Kenya is experiencing a surge in demand, driven by a growing affluent population and an increasing number of expatriates seeking high-end properties20. Nairobi's luxury property market has been ranked 52nd in the world in Knight Frank's Prime International Residential Index, 2024, outperforming major cities in the developed world20. Popular locations for luxury homes in Nairobi include Westlands, Lavington, Karen, Kilimani, and Kileleshwa27.

Luxury homes in Kenya often feature amenities such as spacious lounges, well-equipped kitchens, en-suite bedrooms, swimming pools, gyms, and landscaped gardens28. Internationally, luxury homes are incorporating features like custom closets, home gyms, and spa-like bathrooms to cater to the evolving needs and preferences of affluent buyers29.

Challenges and Opportunities in African Real Estate

While the African real estate market offers vast opportunities, challenges such as regulatory barriers, infrastructure deficits, and political risks need to be carefully managed30.

-

Infrastructure Deficits: Inadequate infrastructure, such as poor roads, unreliable electricity, and limited access to clean water, can hinder real estate development in many African countries31.

-

Land Ownership Disputes: Land ownership disputes are common in many African countries due to weak legal frameworks, unclear title deeds, and corruption. This can make it difficult for developers to acquire land and can delay or derail real estate projects31.

-

Political Instability: Political instability in some African countries can deter foreign investment in the real estate market. Investors are often wary of markets where political uncertainty or conflict could disrupt economic activities and affect property values31.

Despite these challenges, the African real estate market presents unique opportunities for investors.

-

Urbanization and Population Growth: Africa is experiencing rapid urbanization and population growth, leading to increased demand for housing and commercial properties31.

-

Technological Advancements: The adoption of technology in the real estate sector, such as Proptech, is improving transparency and efficiency in property transactions31.

-

Sustainability and Green Building: There is a growing focus on sustainable development and green building practices in Africa, creating opportunities for investors in eco-friendly projects31.

Compared to other continents, the African real estate market offers several advantages, including relative affordability, robust economic growth, and a growing middle class with a heightened demand for high-quality housing32. However, it is essential for investors to conduct thorough due diligence and partner with experts who understand the nuances of each market30.

Key Players in the Kenyan Real Estate Market

Several real estate companies are operating in Kenya, contributing to the growth and development of the sector. One such company is Kings Developers, known for its diverse portfolio of residential and commercial projects33. Kings Developers targets various market segments, from affordable housing for middle-income families to luxury residences for high-net-worth individuals34.

Factors to Consider When Choosing Between Long-Term and Short-Term Investments

When deciding between long-term and short-term real estate investments, investors should consider the following factors:

-

Financial Goals: Long-term investments are suitable for building wealth gradually and generating passive income, while short-term investments are ideal for quick returns and capitalizing on market opportunities14. For example, an investor with a long-term horizon and a moderate risk tolerance might consider investing in a rental property in a growing neighborhood, while an investor seeking quick returns and comfortable with higher risk might opt for a flipping strategy.

-

Risk Tolerance: Short-term investments generally carry higher risk due to market fluctuations and the need for quick turnaround times35. Investors with a lower risk tolerance might prefer long-term investments with more predictable returns, while those with a higher risk appetite might be more comfortable with short-term strategies.

-

Time Horizon: Long-term investments require a longer commitment, while short-term investments allow for greater flexibility and quicker access to capital36. Investors with a shorter time horizon might prefer short-term investments, while those with a longer-term outlook might opt for long-term strategies.

-

Market Conditions: Analyze local market trends, rental demand, and property appreciation rates to determine which investment strategy aligns with current conditions37. For example, in a market with high rental demand and low vacancy rates, a long-term rental investment might be more favorable, while in a market with rising property values, a short-term flipping strategy could be more lucrative.

-

Personal Involvement: Short-term investments, particularly short-term rentals, often require more active management and involvement compared to long-term investments38. Investors who prefer a more hands-off approach might prefer long-term investments, while those who are comfortable with active management might opt for short-term strategies.

Top Upcoming Real Estate Projects in Africa

Several upcoming real estate projects in Africa offer promising investment opportunities.

-

Eko Atlantic City: This ambitious project in Lagos, Nigeria, is transforming the coastline into a world-class destination39. With its modern infrastructure, luxury residences, and commercial spaces, Eko Atlantic City presents a unique opportunity for both long-term and short-term investments.

-

Kanza Technology City: Located in Kenya, Kanza Technology City is a sustainable city project that aims to drive economic growth in the tech and communication sectors40. With its focus on technology and green living, Kanza Technology City offers investment potential in residential, commercial, and industrial properties.

Conclusion

Kenya's real estate market offers a diverse range of investment opportunities, each with its own set of advantages and challenges. Long-term investments provide stability, passive income, and tax benefits, while short-term investments offer quick returns and market flexibility. The current economic situation in Kenya presents both opportunities and challenges, with factors such as high inflation and a depreciating currency influencing investment decisions. By carefully considering their financial goals, risk tolerance, time horizon, market conditions, and desired level of personal involvement, investors can make informed decisions and navigate the Kenyan real estate market successfully. Ultimately, the choice between long-term and short-term real estate investments depends on the individual investor's circumstances and preferences.

Works cited

1. Current Real Estate Trends in Kenya & How They Affect Investors - MoneyRise - Risevest, accessed February 4, 2025, https://risevest.com/blog/real-estate-trends-in-kenya

2. Types of Real Estate Investments in Kenya - BKRealty, accessed February 4, 2025, https://bkrealty.co.ke/types-of-real-estate-investments/

3. Long-Term vs Short-Term Property Investment in Kenya, accessed February 4, 2025, https://koch-properties.com/blog/long-term-vs-short-term-property-investment-in-kenya_675be8f323642dbb871341e2

4. Investor Guide | Introduction - Two Rivers Development, accessed February 4, 2025, https://www.tworivers-development.com/investor-guide/guide/full-version/index

5. Two Rivers International Finance and Innovation Centre (TRIFIC) Offering, accessed February 4, 2025, https://trific.co.ke/wp-content/uploads/2023/07/TRIFIC_-Overview.pdf

6. The Government of Rwanda, Africa50 and BADEA break ground on the construction of Kigali Innovation City (KIC), accessed February 4, 2025, https://rdb.rw/the-government-of-rwanda-africa50-and-badea-break-ground-on-the-construction-of-kigali-innovation-city/

7. Kigali's $2 Billion Innovation City Construction Scheduled to Begin in September 2024, accessed February 4, 2025, https://www.afrikavantage.com/post/kigali-s-2-billion-innovation-city-construction-to-begin-following-implementation-agreements-signed

8. Eko Atlantic - Wikipedia, accessed February 4, 2025, https://en.wikipedia.org/wiki/Eko_Atlantic

9. About Eko Atlantic, accessed February 4, 2025, https://www.ekoatlantic.com/about-eko-atlantic/

10. Real Estate Investing: The Pros And Cons Investors Should Know - DoorLoop, accessed February 4, 2025, https://www.doorloop.com/blog/pro-cons-real-estate-investing

11. The Pros and Cons of Owning an Investment Property - Reinhart Realtors, accessed February 4, 2025, https://www.reinhartrealtors.com/blog/the-pros-and-cons-of-owning-an-investment-property/

12. Is Real Estate a Good Investment? 16 Pros & Cons - RealWealth, accessed February 4, 2025, https://realwealth.com/learn/is-real-estate-a-good-investment/

13. Short-term Rental Investing in Kenya, Pros and Cons - Zurafa Properties, accessed February 4, 2025, https://www.zurafaproperties.com/blog/off-plan-buying-kenya

14. Short-Term vs. Long-Term Real Estate Investing | Gatsby Investment, accessed February 4, 2025, https://www.gatsbyinvestment.com/education-center/short-term-long-term-real-estate-investing

15. Pros and Cons of Investing in Short-Term Rentals - Raleigh Realty, accessed February 4, 2025, https://raleighrealty.com/blog/investing-in-short-term-rentals

16. Pros and Cons of Investing in Vacation Rental Properties - RCN Capital, accessed February 4, 2025, https://rcncapital.com/blog/pros-and-cons-of-investing-in-vacation-rental-properties

17. Short-term Rental Vs. Long-term Rental: 12 Things To Know - Good Life Property Management, accessed February 4, 2025, https://www.goodlifemgmt.com/blog/short-term-rental-vs-long-term-rental/

18. www.worldbank.org, accessed February 4, 2025, https://www.worldbank.org/en/country/kenya/overview#:~:text=Kenya's%20real%20GDP%20expanded%20at,downward%20trajectory%20for%20poverty%20rates.

19. Real estate defies expectations as the sector demonstrates stability across subsectors in Africa | Standard Bank, accessed February 4, 2025, https://corporateandinvestment.standardbank.com/cib/global/who-we-are/about-us/news/real-estate-defies-expectations-as-the-sector-demonstrates-stability-across-subsectors-in-africa

20. Here's why luxury real estate is gaining mileage in 2024 - Daily Nation, accessed February 4, 2025, https://nation.africa/kenya/life-and-style/dn2/here-s-why-luxury-real-estate-is-gaining-mileage-in-2024--4767166

21. Kenya's economy: how is the government tackling the big challenges?, accessed February 4, 2025, https://www.economicsobservatory.com/kenyas-economy-how-is-the-government-tackling-the-big-challenges

22. Africa's real estate sector poised for steady growth - CNBC Africa, accessed February 4, 2025, https://www.cnbcafrica.com/media/6348484775112/africas-real-estate-sector-poised-for-steady-growth/

23. Kenya Overview: Development news, research, data | World Bank, accessed February 4, 2025, https://www.worldbank.org/en/country/kenya/overview

24. Current Real Estate Trends in Kenya & How They Affect Investors - Cytonn Investments, accessed February 4, 2025, https://cytonn.com/blog/article/current-real-estate-trends-in-kenya-and-how-they-affect-investors

25. The ROI of Real Estate Investment in Kenya - Kings Developers, accessed February 4, 2025, https://kingsdevelopers.com/blog-page/the-roi-of-real-estate-investment-in-kenya_11/

26. Leading Kenya's Real Estate Market with Vision and Purpose - Forbes Africa, accessed February 4, 2025, https://www.forbesafrica.com/africa-undiscovered/2025/02/03/leading-kenyas-real-estate-market-with-vision-and-purpose/

27. Why Is There a Surge in Luxury Real Estate Developments in Kenya? - BuyRentKenya, accessed February 4, 2025, https://www.buyrentkenya.com/discover/surge-in-luxury-real-estate-developments-kenya

28. Top 5 KENYA'S Most Luxury Gated Communities | Where The Rich Hide in Nairobi, accessed February 4, 2025, https://www.youtube.com/watch?v=lk_Wd12NrWU

29. 8 Essential Things Every Luxury Home Needs | Forbes Global Properties, accessed February 4, 2025, https://www.forbesglobalproperties.com/insights/8-essential-things-every-luxury-home-needs

30. Real Estate Investors in Africa - Volition Cap, accessed February 4, 2025, https://volitioncap.com/a-growing-frontier-of-real-estate-investors-in-africa/

31. The Future of Real Estate in Africa: Trends, Opportunities, and ..., accessed February 4, 2025, https://blog.buyletlive.com/research-insights/the-future-of-real-estate-in-africa-trends-opportunities-and-challenges/

32. Exploring 2024 Emerging Trends in Asia's Real Estate Market - Riverhouse Phuket, accessed February 4, 2025, https://riverhousephuket.com/exploring-2024-emerging-trends-in-asias-real-estate-market/

33. The Rise of Kings Developers: A Trusted Name in Nairobi's Real Estate Market, accessed February 4, 2025, https://kingsdevelopers.com/blog-page/the-rise-of-kings-developers_14/

34. Talking To Moiz Hassanali, A Director At Kings Developers - BuyRentKenya, accessed February 4, 2025, https://www.buyrentkenya.com/discover/talking-to-moiz-hassanali-a-director-at-kings-developers

35. Long- or Short-Term Rentals: Which Investment Strategy Is Right for You? - REI Hub, accessed February 4, 2025, https://www.reihub.net/resources/comparing-long-and-short-term-rentals/

36. Investing in a Long- or Short-Term Rental Property - Charles Schwab, accessed February 4, 2025, https://www.schwab.com/learn/story/investing-long-or-short-term-rental-property

37. The Most Important Factors for Real Estate Investing - Investopedia, accessed February 4, 2025, https://www.investopedia.com/articles/investing/110614/most-important-factors-investing-real-estate.asp

38. 7 Factors to Consider When Choosing a Profitable Long-Term Rental Property, accessed February 4, 2025, https://rcncapital.com/blog/7-factors-to-consider-when-choosing-a-profitable-long-term-rental-property

39. Top 15 Real Estate Construction Projects in Nigeria, 2025 - The Building Practice Ltd, accessed February 4, 2025, https://buildingpractice.biz/top-real-estate-projects-in-nigeria/

40. Top 10 Construction Projects Completing in 2025 In Africa - YouTube, accessed February 4, 2025, https://www.youtube.com/watch?v=pyMXs6Bd4JY